The Predictive Pulse: How Motor Monitoring is Transitioning from Maintenance to Strategic Foresight

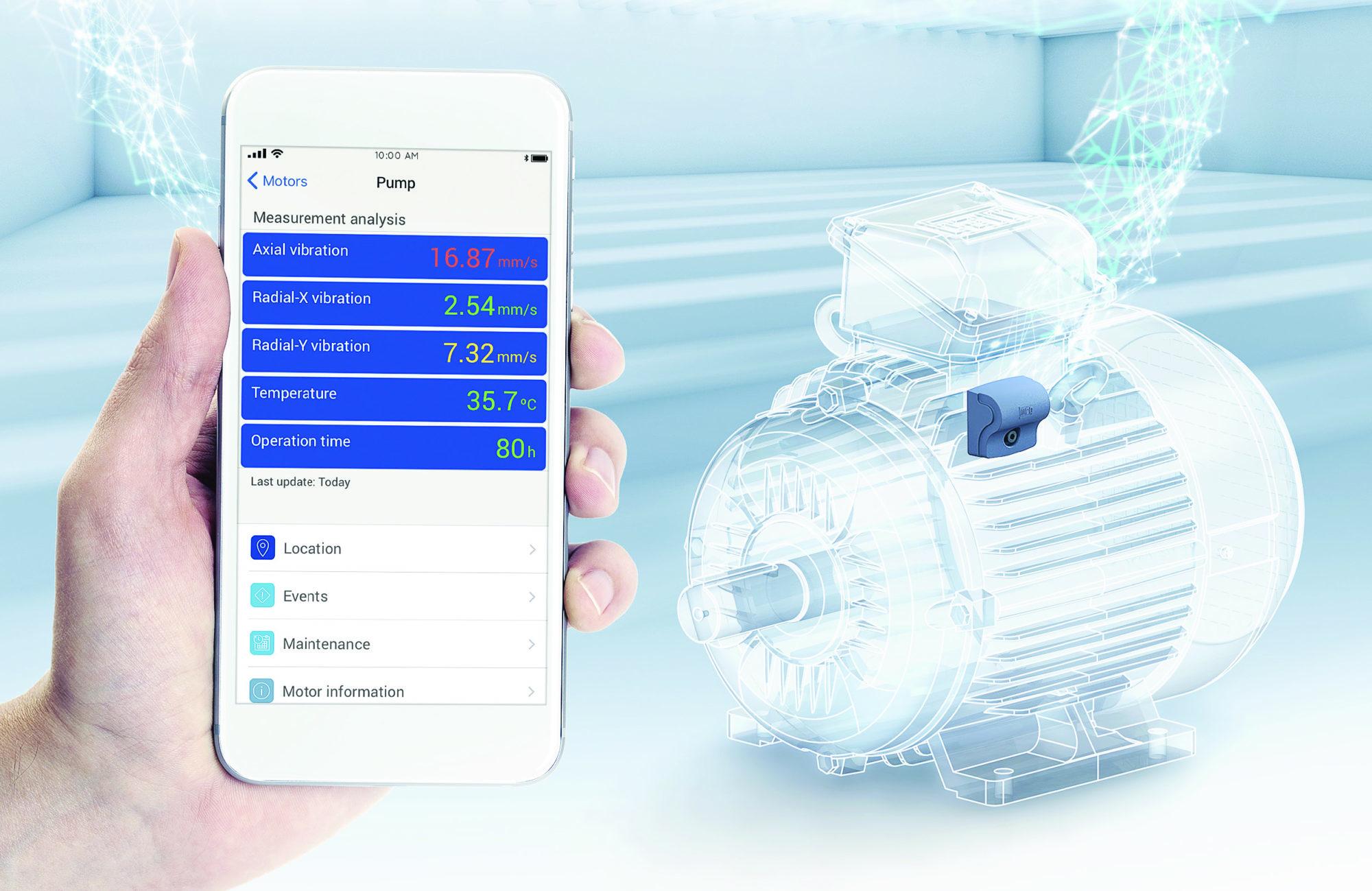

In the heart of industrial facilities worldwide, a critical transformation is underway in how we manage the most ubiquitous asset: the electric motor. Motor monitoring, the practice of tracking the health and performance of motors in real-time, has evolved from simple vibration sticks to sophisticated AI-driven platforms. This shift is turning routine maintenance into a strategic function, preventing costly downtime, optimizing energy consumption, and providing a continuous stream of data that is becoming the lifeblood of operational intelligence.

According to Straits Research, the global motor monitoring sector was valued at USD 3.46 billion in 2024. It is projected to reach from USD 3.71 billion in 2025 to USD 6.43 billion by 2033, growing at a CAGR of 7.1% during the forecast period (2025-2033). This steady growth underscores its transition from a niche technical practice to a core component of modern industrial operations and smart factory initiatives.

Key Players and Geographic Strategies

The competitive landscape is a blend of industrial automation giants and specialized technology firms.

-

North America: A hub for innovation, particularly in software and cloud analytics. Emerson Electric (USA) is a leader with its AMS Suite of predictive monitoring software, which integrates vibration analysis and other data to provide a holistic view of motor health. Honeywell (USA) offers connected motor monitoring solutions that feed data directly into its broader asset performance management ecosystem. Banner Engineering (USA) provides a range of wireless vibration and temperature sensors that make it easier to deploy monitoring on critical assets.

-

Europe: European firms excel in precision engineering and integration with heavy industry. ABB (Switzerland) and Siemens (Germany) are powerhouses, offering integrated motor and drive systems that come with built-in monitoring capabilities and connectivity to their larger industrial IoT platforms. SKF (Sweden), a long-standing leader in bearings, has successfully expanded into full-scale condition monitoring services, leveraging its deep mechanical expertise.

-

Asia-Pacific: The region is a major growth area driven by rapid industrialization. Mitsubishi Electric (Japan) provides advanced motor monitoring solutions as part of its factory automation offerings. Chinese companies are rapidly adopting these technologies to improve efficiency and compete globally, with local suppliers emerging to serve this demand.

Analysis: Drivers of Growth and Emerging Trends

The 7.1% CAGR is driven by the relentless pressure to reduce unplanned downtime, which is exponentially more costly than planned maintenance. Soaring energy costs also make the optimization of motor efficiency—which accounts for a massive portion of industrial electricity use—a direct financial imperative. The broader adoption of Industry 4.0 principles provides the necessary network infrastructure to support widespread sensor deployment.

Key trends shaping the future of motor monitoring include:

-

Wireless and Vibration-as-a-Service (VaaS): The proliferation of low-cost, wireless IoT sensors has dramatically reduced the barrier to entry. Some providers now offer subscription-based "Vibration-as-a-Service" models, where they provide the sensors, data analysis, and expert recommendations for a monthly fee, eliminating large upfront capital expenditures.

-

AI-Powered Diagnostics: Beyond simple threshold alerts, AI algorithms can now diagnose specific faults—such as bearing wear, rotor bar defects, or misalignment—with high accuracy by learning from vast datasets of motor failures. This moves analysis from "something is wrong" to "this specific component is failing and here’s why."

-

Integration with Energy Management: The most advanced systems don’t just monitor health; they monitor performance. They correlate motor vibration and temperature data with power consumption to identify inefficiencies and recommend operational adjustments that save significant energy.

Recent News and Developments

The industry is advancing through strategic acquisitions and new product launches. Recently, Emerson announced the acquisition of a leading provider of vibration monitoring hardware, aiming to create a more seamless end-to-end solution. SKF launched a new generation of its Enlight ProCollect IMx-1 platform, which combines vibration and temperature data with speed measurements for more accurate analysis on variable speed drives. In a move highlighting the cloud trend, Fluke Corporation (USA) expanded its cloud-connected condition monitoring portfolio, allowing for remote management of assets across multiple facilities.

Summary

Motor monitoring has evolved from a periodic check-up to a continuous, AI-driven health monitor for industrial operations. By providing early and accurate fault detection, it is fundamental to achieving the goals of predictive maintenance, energy efficiency, and operational resilience that define modern industry.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness