Silicon Wafer Innovations Accelerate Semiconductor Performance Worldwide

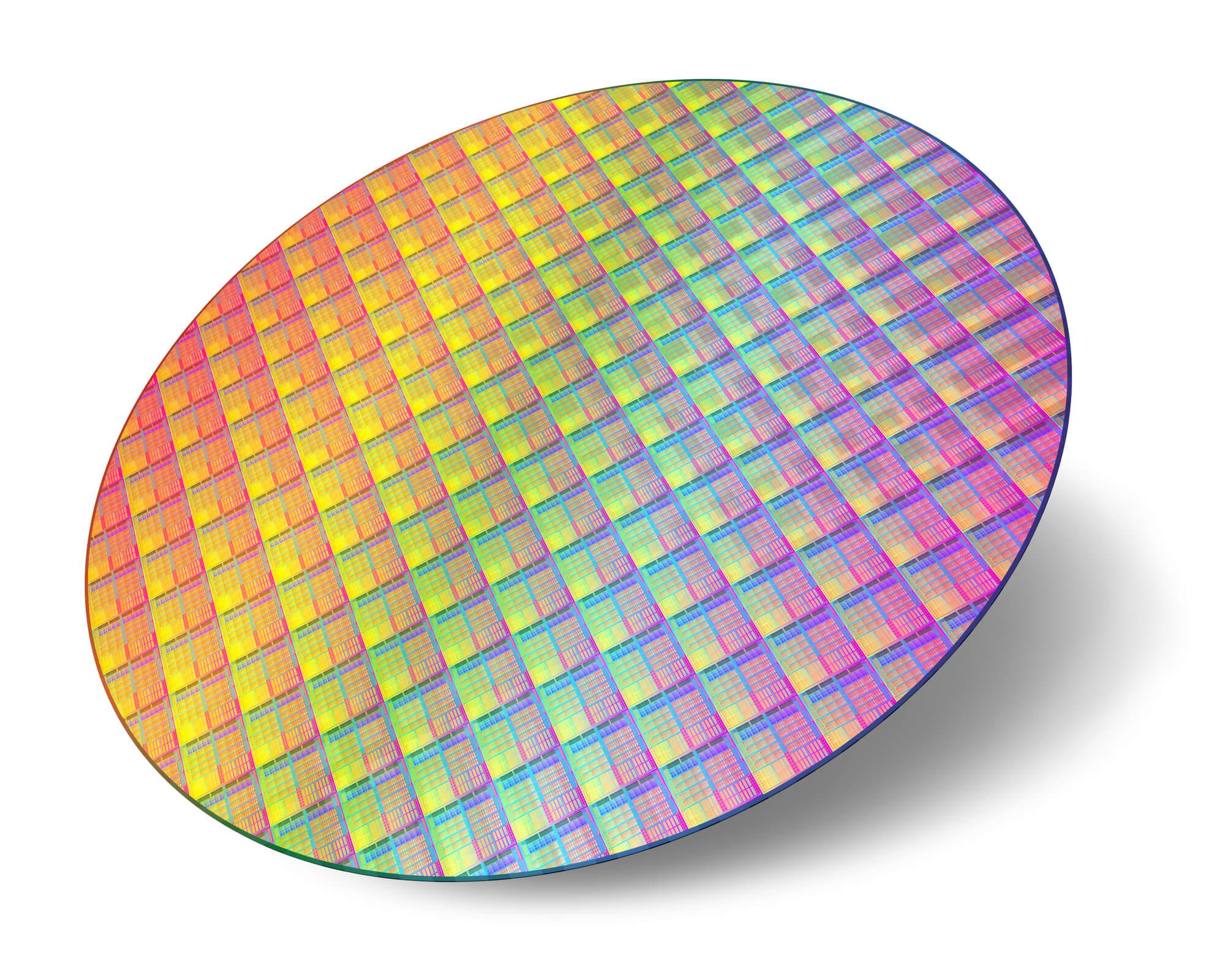

The semiconductor silicon wafer continues to be a cornerstone of modern electronics, pivotal for powering the chips in everything from smartphones to advanced AI systems. As industries push the boundaries of miniaturization and performance, silicon wafers serve as the fundamental substrate for manufacturing high-precision semiconductor devices. In 2025, innovations in wafer processing, rising fabrication capacities, and strategic investments by governments worldwide are shaping the future of this critical technology.

According to Straits Research, the global semiconductor silicon wafer industry was valued at USD 12.56 billion in 2024 and is projected to grow from USD 13.02 billion in 2025 to USD 17.27 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 3.6% during this period. This growth reflects robust demand fueled by technological advancements and increasing applications in sectors such as consumer electronics, automotive, and telecommunications.

Recent Innovations and Technology Trends

Silicon wafer manufacturing is experiencing a technological evolution. Leading trends in 2025 include advancing to smaller chip nodes like 2nm and experimental 1.8nm chips, which require unprecedented precision in lithography and wafer fabrication. Extreme Ultraviolet (EUV) lithography has become a critical enabler of finer transistor scaling, with newer High Numerical Aperture EUV tools further improving wafer pattern accuracy. Additionally, heterogeneous integration and 3D stacking are gaining momentum, facilitating vertical chip packaging through techniques such as through-silicon vias (TSVs) and wafer bonding. This approach enhances device performance while reducing energy consumption and physical space.

Environmental sustainability is also impacting wafer production. Leading manufacturers are adopting green processes such as water reclamation, chemical recycling, and energy-efficient plasma etching to address rising energy costs and regulatory pressures. Companies investing in eco-friendly wafer fabs are positioning themselves for competitive advantage in the sustainable electronics ecosystem.

Key Players and Regional Developments

The global supply chain for silicon wafers remains competitive yet consolidated among a few major corporations. Shin-Etsu Handotai (Japan), Siltronic AG (Germany), SUMCO Corporation (Japan), SK Siltron Co., Ltd. (South Korea), and GlobalWafers Co., Ltd. (Taiwan) dominate production with continuous investments in capacity expansion and technology upgrades.

Asia-Pacific holds the lion's share in wafer production, accounting for approximately 68.5% of the global output in 2024. This dominance is driven by strong semiconductor manufacturing infrastructure in countries like China, Japan, South Korea, Taiwan, and Singapore, supported by government initiatives and significant R&D funding. China's National Integrated Circuit Sector Investment Fund exemplifies the policy role in promoting wafer manufacturing growth through regional innovation clusters.

Meanwhile, North America is intensifying its wafer fabrication capabilities, spearheaded by Taiwan Semiconductor Manufacturing Company (TSMC)'s plans for advanced 5nm wafer plants in Arizona, along with several suppliers following suit. This strategic push aligns with the United States' goal to reduce reliance on external semiconductor sources and compete in emerging chip technologies necessitated by AI, 5G, and electric vehicles. North America's fabless semiconductor design ecosystem also contributes heavily to the demand for high-quality silicon wafers.

Europe is also witnessing growth through its commitments to electrification, renewable energy, and data center expansion that require advanced chips built on quality silicon wafers. The region boosts its wafer landscape via investments in miniaturization technologies and foundry capabilities aimed at enhancing its semiconductor self-sufficiency.

Notable Recent News

In India, significant momentum marks the semiconductor sector with the government's approval of multiple manufacturing units and fabrication plants, including compound semiconductor fabs targeting silicon carbide wafers. These projects, such as those by SiCSem and Continental Device India Ltd., with investments around Rs. 4,600 crore, aim to strengthen the domestic ecosystem and support applications in electric vehicles, defense, and renewable energy.

Wolfspeed, Inc., a leader in silicon carbide technology, extended a major silicon carbide wafer supply deal in 2024 valued at approximately USD 275 million, reinforcing the growing preference for silicon carbide over traditional silicon in power devices.

Nidec Instruments launched innovative semiconductor wafer transfer robots, enhancing automation and precision in wafer handling processes, meeting emerging industry demands.

Growth Outlook

Looking ahead, the silicon wafer sector is poised for steady growth across global regions. Asia-Pacific will continue to lead but faces rising competition from North America and Europe, where strategic investments and incentives are elevating manufacturing capacity and innovation. Market drivers include demand for semiconductors in AI, 5G, automotive electronics, and sustainable energy solutions. The trend toward smaller, more efficient chips with 3D architectures and advanced materials further catalyzes wafer demand. Manufacturing sustainability will remain a critical consideration, influencing capital allocation and technology adoption.

Summary

The semiconductor silicon wafer industry is at the forefront of enabling next-generation technology innovation, supported by advanced manufacturing techniques and strong regional investments worldwide.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness