Global Fasteners Market: Growth, Innovation, and New Industry Opportunities

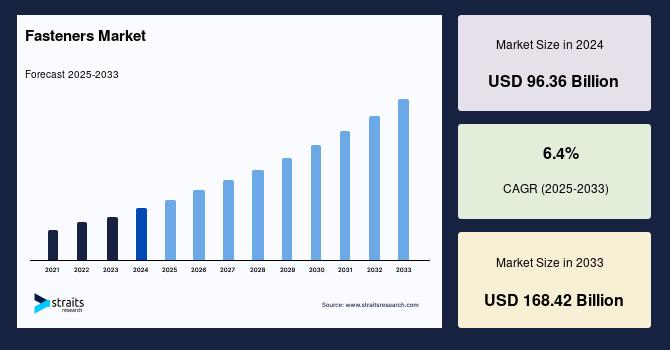

The global fasteners market size was valued at USD 96.36 billion in 2024. It is projected to reach an expected value from USD 102.53 billion by 2025 to USD 168.42 billion by 2033, growing at a CAGR of 6.4% during the forecast period (2025-2033). The substitution of metal fasteners with plastic fasteners is a great opportunity in the global market.

The global fasteners market has become a cornerstone for modern manufacturing, construction, and infrastructure development. Fasteners, used to mechanically join components in a wide range of products and structures, are vital for ensuring stability, safety, and performance across industries. As technological advancement and economic growth accelerate worldwide, the demand and evolution of fasteners are entering an exciting new phase. This article explores the size, trends, drivers, and future outlook of the fasteners market in detail.

Market Size and Growth Momentum

The fasteners industry has seen dramatic expansion in recent years. In 2024, the market was valued at nearly USD 96 billion, and forecasts suggest robust growth will persist over the next decade. By 2033, the market size could reach approximately USD 168 billion, driven by a compound annual growth rate (CAGR) of 6.4%. Such impressive growth is the result of increasing industrialization, infrastructure activities, and advances in sectors like automotive, electronics, and construction.

Asia-Pacific continues to command the largest share and fastest growth rate in the global fasteners market. Several factors contribute to this dominance: rapid expansion of car production in China and India, increasing investments in infrastructure, and evolving consumer needs. Meanwhile, Europe and North America also play significant roles, with strong demand from automotive manufacturing, aerospace innovation, and a steady pipeline of construction projects.

Material Innovation and Specialty Fasteners

Traditionally, metal fasteners carved out the bulk of the market, owing to their superior mechanical strength and versatility. Steel, particularly stainless stee,l remains the most preferred material due to its high tensile strength, corrosion resistance, and durability, making it ideal for applications exposed to extreme conditions. Aluminum is also gaining traction, especially as industries seek lightweight alternatives without compromising structural integrity.

However, a seismic shift is underway as plastic fasteners grow in popularity, primarily in automotive and electronics. Advantages such as reduced weight, lower costs, and adaptability to complex shapes have positioned plastic fasteners as attractive solutions for manufacturers seeking efficiency and compliance with stringent industry requirements. The proliferation of injection molding technology further enables customization and mass production of unique fastener types.

Specialty fasteners, those engineered for non-standard applications, are experiencing surging demand. End-use industries now require tailored fasteners that meet exact durability, strength, and aesthetic standards. Innovations in design, head styles, and coatings make these products ideal for sectors demanding higher performance, such as aerospace and high-end electronics.

Industry Drivers and Challenges

The automotive industry stands out as the largest consumer of fasteners globally. Components like bolts, screws, nuts, rivets, and studs are essential during vehicle assembly, ensuring safety and structural integrity. With the rise of electric vehicles, hybrid technology, and the need for lightweight construction, manufacturers are investing heavily in evolving fastener designs. Asia-Pacific’s automotive boom, coupled with emergent trends in electric transportation, is projected to accelerate fastener consumption even further.

Construction is another major growth sector. Fasteners play critical roles in attaching components, cable management, and ensuring the long-term durability of buildings, bridges, and industrial infrastructures. Stringent quality standards enforced by government regulation in construction demand high-performing, standardized products that can withstand severe wear and tear.

Yet, the fasteners industry is not without challenges. Rising metal prices, coupled with expanding use of substitutes like adhesives, tapes, and welding techniques, put pressure on traditional fastener manufacturers. Automotive, aerospace, and packaging sectors are increasingly exploring these alternatives to meet demands for reliability and cost-effectiveness. The evolution and commercialization of laser welding technology in the automotive and aircraft industries also pose threats to fastener market share.

Regional Insights and Future Opportunities

Asia-Pacific’s remarkable trajectory is driven by its position as both a manufacturer and consumer superpower. Major developments in infrastructure and industry like smart cities, highways, and industrial zones, create enormous demand for all types of fasteners. Europe remains a steady force, driven by automotive R&D, premium vehicle manufacturing, and construction excellence, while North America continues to innovate in aerospace, electronics, and automotive sectors.

The market’s future shines with opportunity. As consumer preferences evolve and sustainability takes center stage, industry players are investing in research, innovation, and customization. The increasing adoption of specialty fasteners and advanced materials will only accelerate as manufacturers seek lightweight, cost-effective, and durable solutions.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness