Automotive Ceramics Market: Driving Innovation for Efficient and Sustainable Mobility

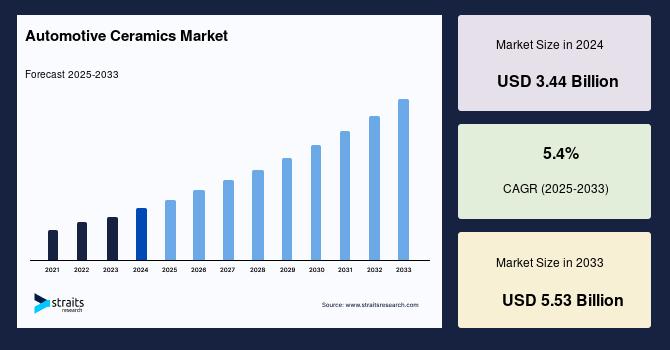

The global Automotive Ceramics Market Size was valued at USD 3.44 billion in 2024 and is projected to reach from USD 3.63 billion in 2025 to USD 5.53 billion by 2033, growing at a CAGR of 5.4% during the forecast period (2025-2033).

Importance and Advantages of Automotive Ceramics

Ceramic materials have emerged as essential components in automotive manufacturing due to their ability to withstand high temperatures, resist wear, and provide electrical insulation, all while remaining cost-effective compared to metals and more durable than plastics. These qualities make ceramics highly desirable for parts such as sensors, mechanical seals, bearings, valves, and various engine components.

Ceramics contribute significantly to improvements in driving dynamics and environmental compliance by facilitating the purification of exhaust gases and enhancing fuel efficiency. Advanced ceramics, such as silicon nitride used in engine parts, oxygen sensors, exhaust gas catalysts, and knock sensors, are integral to the performance, durability, and thermal insulation of modern vehicles.

Addressing Emission Challenges

One of the primary challenges in the automotive sector is managing vehicle emissions, which are a major contributor to air pollution and climate change. Governments worldwide are imposing increasingly stringent emission regulations, encouraging the adoption of cleaner technologies. Ceramic components, especially Diesel Particulate Filters (DPFs), have become critical in reducing harmful exhaust emissions. These ceramic filters can remove nearly all soot from diesel exhaust, drastically lowering pollution from trucks, coaches, and heavy machinery.

Ceramic wall-flow filters efficiently trap fine particulate matter, outperforming metal fiber counterparts in durability and cost-effectiveness. Materials such as cordierite and silicon carbide are preferred for their minimal impact on back pressure and ease of maintenance, further driving their widespread use in emissions control.

Impact on Fuel Efficiency and Engine Performance

Ceramics have also been influential in boosting fuel efficiency by allowing engines to operate at higher temperatures, enabling more complete combustion of fuel and reducing emissions. Ceramic coatings on pistons and piston rings reduce friction, while refractory ceramics serve as discrete engine parts and protective coatings for metallic components. These improvements collectively facilitate lower fuel consumption and enhanced engine longevity.

In electric and hybrid vehicles, alumina ceramics provide superior wear resistance and vibration damping for shafts and bearings, thereby improving ride comfort and extending component lifespan. The demand for such advanced ceramics is expected to rise sharply with the expanding electric vehicle market, offering enhanced safety, higher efficiency, and longer system life.

Market Challenges

Despite their numerous advantages, ceramics present certain challenges that could temper market growth. The higher cost of raw materials and complex manufacturing processes limits the broader adoption of ceramics in automotive production. Additionally, recycling ceramics poses difficulties, adding to the environmental and fiscal challenges within the supply chain.

The costly design and development phase, which requires significant R&D investment to tailor ceramic components to specific applications, also represents a barrier for some manufacturers. However, ongoing innovations in cost-effective ceramic manufacturing technologies are anticipated to create new opportunities in this segment.

Regional Market Highlights

Asia-Pacific holds the largest share of the global automotive ceramics market and is expected to maintain rapid growth at a CAGR of 6.8%. This dominance stems from the substantial automotive manufacturing base and increasing production of electric vehicles in countries like China, India, Japan, and South Korea. Favorable factors include abundant raw materials, affordable transportation costs, and a robust workforce. Government initiatives like India’s "Make in India" program are further catalyzing investment and expansion in the region’s automotive sector.

Europe's automotive ceramics market is forecast to grow steadily at around 3.4% CAGR, driven by rigorous governmental emissions regulations and a strong focus on electric vehicle production. Germany, the largest automotive market in Europe, leads efforts in reducing vehicle emissions with the support of major manufacturers and investments like Tesla’s Gigafactory.

In North America, the market is buoyed by rapid technological advancements spearheaded by companies like Tesla. High disposable income and increasing fuel prices have accelerated the demand for electric and energy-efficient vehicles, promoting the adoption of ceramic materials in vehicle manufacturing.

Segment Analysis

Passenger vehicles contribute the most to the market and are expected to grow at approximately 8.3% annually. This sector benefits from rising incomes, easier access to financing, and governmental incentives for electric vehicle purchases. Increasing consumer demand for fuel-efficient vehicles spurs the integration of advanced ceramics in passenger car manufacturing.

Among materials, alumina oxide holds the highest market share, thanks to its excellent mechanical strength, wear resistance, and electrical properties. Alumina’s application extends to thermal barrier coatings and various electronic components within vehicles, enhancing performance and safety, especially in electric and hybrid vehicles.

Automotive engine parts represent the largest application segment. Advanced ceramics reduce wear and tear, improve fuel efficiency by optimizing combustion, and provide superior heat resistance. Key ceramic components include spark plug insulators, piston rings, and engine coatings—all contributing to engine reliability and efficiency. For instance, spark plug insulators made from high-purity alumina offer high voltage tolerance and corrosion resistance even at elevated temperatures.

Future Outlook

The automotive ceramics market is positioned for ongoing expansion, driven by technological innovation, regulatory demands, and the shift toward cleaner, more efficient vehicles. As electric vehicle adoption accelerates, the role of ceramics in battery management, thermal regulation, and electronic components will become even more critical.

Investment in R&D to lower production costs and improve ceramic recycling is likely to unlock new market segments and encourage further integration of ceramics in automotive applications. With sustainability and performance at the forefront, automotive ceramics will continue to be vital in shaping the future of mobility.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness